Has Alert Innovation designed the ultimate automated store?

You’ve no doubt heard about automated stores. Maybe you’ve even visited one. While these stores tend to focus on automation in terms of customer checkout, Alert Innovation has conceived a truly automated supermarket.

Its Novastore concept looks to combine customer self-service for fresh goods like produce and meat, with automated robot retrieval for everything else. No more wandering the cereal or tin aisles. You’ll order everything to be picked by robots whether you’re shopping in-store or for delivery at home.

It goes without saying that the company’s Alphabot robot is key to the whole concept. With the robot currently in pilot at Wal-Mart, we spoke to founder/CEO John Lert to learn more about Alert Innovation’s vision of automation, why the current online grocery model is unsustainable and how retail is making a mistake with separate facilities for online orders:

John Lert, Founder/CEO, Alert Innovation

What inspired you to start Alert Innovation?

I’ve been working on the idea of an automated supermarket where machines pick all the packaged goods for over 25 years.

I’ve spent my whole career trying to apply technology to solve business problems and I saw the opportunity to innovate food retailing. It’s a very complicated business operating at high scale on thin margins and is very under-penetrated by technology. It led me into thinking about automation as a way to create a step change in the capabilities of the store and also in the depth and breadth and flexibility of user experience.

My co-founder and co-inventor, Bill Fosnight, and I conceived of the current Alphabot robot and system design in 2015 and we started operating in 2016. We had our first meeting with Wal-Mart then. They were looking to be able to automate online grocery pickup at store level and felt that this could become the best technology solution.

As of February 2019, we have our first pilot system up and running in a Wal-Mart Supercenter in New Hampshire about 30 minutes from our office. We’re in low level production. We are filling live orders as a way of testing the interface and making sure that we’re supporting the Wal-Mart operation, but we haven’t started scaling production yet.

At the same time, we’re also pushing forward with Novastore, which is our vision of the automated supermarket that uses Alphabot to fulfil all packaged goods orders. We’re looking first at new store developments for that, but the technology is so compact that it can actually retrofit into any supermarket of 30,000 sq ft or larger.

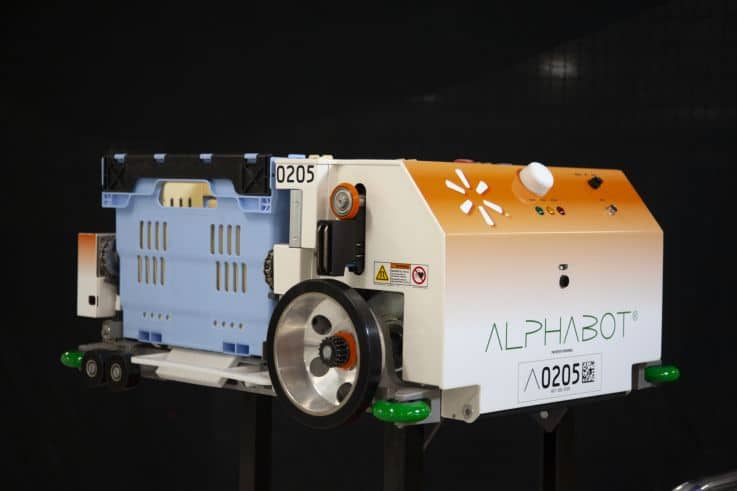

Can you explain what the Alphabot is and how it works?

Alphabot is an Automated Storage and Retrieval System (ASRS) and Automated Each-Picking System (AEPS) that uses a mobile robot to do everything. The only moving part in the product retrieval system is the robot. The robot is equipped with a tote container to transfer goods in and out of storage for order picking or to restock inventory, and to carry picked orders for customers.

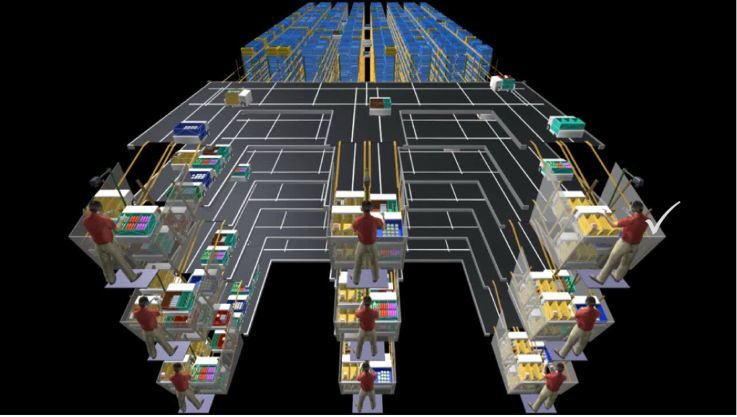

What makes the Alphabot mobile robot unique is that it can moves in all three dimensions. It moves in two horizontal dimensions on decks using differential steering and linearly on rails within storage aisles (at up to six meters per second), and at the end of each aisle are vertical columns with a gear rack which the robot can engage with to move vertically to any storage or workstation elevation.

That capability allows us to have a completely three-dimensional vertical architecture, in both the storage and workstation elements. We can effectively stack the pick stations vertically from floor to ceiling and the robots can access any of those workstations. We have a storage level about every 15 inches and in the workstation area we have a set of workstations every eight feet.

The architecture gives us a great deal of scalability and flexibility in design and reliability because any one robot can break and all the rest of the robots can work around it. There’s no single point of failure. It’s very capital efficient because it’s only one moving part.

We get 100% duty-cycle out of the robot because it doesn’t use chemical batteries, so it never has to go out of service to charge. It uses supercapacitors to store energy and those are charged every time the robot moves vertically.

We also have the kind of flexibility with this architecture that the robots could leave the system and run on rails at elevation above working space on the shop floor to be able to deliver, for example, the orders to customers’ cars in the parking lot. That’s on our roadmap.

How does the picking system work?

The robot doesn’t do the picking. It will bring totes containing products to the workstation for picking. We can compartmentalize the tote so it can handle as many as eight different SKUs in one tote if they’re small or use a single tote for larger items like cereal boxes.

Two robots will come to the workstation – one with an order tote with three empty shopping bags and the other with the first product to go in that order. A human picker will transfer goods between product containers and order containers. We then flow multiple product robots through the workstation to contribute to each order. When that order is filled, then another robot presents another order container and we flow product robots to that.

We can also reverse that process so we can bring a tote containing a fast-moving product to the workstation and flow orders that are going to receive that item past the stationary product container. At the moment the workstation is designed for humans, but we have futureproofed it so we can put a robot there relatively easily once such robots are available.

Can you share any performance information for the Alphabot pilot so far?

Our design target, which we are still confident we are on track to achieve, is at least 800 picks an hour. Our ultimate target is 1000 but we feel that we’re already at 800 based on the performance of the robot.

How much can your system increase a supermarket’s operating margin?

What’s happening today with human beings picking the online orders for retailers is clearly not sustainable. I don’t believe there’s a retailer in the country that’s actually making money on online grocery by paying their people to pick orders from the store shelves that customers used to otherwise pick for free.

All the pricing is premised on customers picking the orders (self-service) and when the retailer has to pay to have those orders picked, handled, staged, stored and then transferred to a customer at the store, or even worse put on a truck and delivered to the customer at home, those are all additional costs that simply cannot be borne out of existing price structures. At the same time, they can’t raise the prices because it’s a highly competitive market and customers are very price sensitive.

By automating the entire fulfillment process, we can enable this fast-growing segment of the grocery business to be profitable for the retailer.

It’s generally understood across the industry that a typical online order contains about an hour’s worth of labour to pick, prepare and handle before it gets to the customer. That’s not including the delivery cost and so on. The typical industry pick rates are 80 items an hour. If you think about 80 items an hour versus 800 items an hour using the Alphabot then we eliminate 90% of the pick labour.

We also have the opportunity to improve additional processes like storing, staging and retrieving orders when the customer comes to collect. We can take that hour of labour costs down to just a few minutes once we’re fully deployed.

In a fully automated supermarket like Novastore, the economic benefits are much more extensive because by isolating all of the packaged goods into the pick system we do a number of things. For example, we eliminate all theft because robots don’t steal from retailers.

We also save real estate space as we can allow retailers to build much smaller footprint spaces if they’re building new stores, or in an existing store we can actually free up space because our system is so compact. The third is that we save on energy because the robots don’t need air conditioning or lighting and the chilled and frozen sections of the Alphabot are much more energy efficient than in-store chilled and frozen display fixtures.

What is your take on dark stores for online orders versus picking in-store?

It has to be done at store level. What a lot of people have not yet realized is that building separate facilities to support online orders instead of picking at the store means that the retailer is now creating two competing supply chains. Customers can either go to shop at their existing stores or they can shop online and either pick-up at one of the new dark stores or get it delivered.

By giving them that choice you’re allowing the revenues that are supporting the stores to go to the alternative supply chain. The more successful the retailer is with those dark stores the faster they will go out of business in their self-service stores because they’re cannibalizing their own stores. They can’t reduce the fixed costs as they have to pay the rent and utilities and there has to be people there to run the store. Those costs continue to run while the revenues are going elsewhere within the retailers’ organization.

We believe that that is the path to doom. The stores are highly leveraged businesses because of those fixed costs. Every percentage drop in revenue is going to be a larger percentage drop in profit. If you take the revenues out, all of a sudden, you’re removing the gross margin that support those fixed costs. It doesn’t take a big shift before you’re losing money in those stores.

It has to be done at store level. That’s the conundrum. We believe that stores are not big enough to just put automation in and still run the store as it is. That space has to come from reducing assortment to free up space in the store and when retailers reduce assortment they lose baskets because if those products are important then customers will start buying them at other retailers.

This is why grocery has not been penetrated by online like other categories. People want the convenience, but retailers can’t make money on it. There’s no path to profitability. The products have to be local because they’re perishable so you have to have the stores and they can’t afford to manually pick at the stores, and they can’t afford to automate in separate stores. You have to come back to automating the store and there’s just not enough space to run parallel automated fulfillment for online orders and self-service fulfillment in the main store. Something has to give.

We believe the only answer long-term is to automate that entire center-store so all packaged goods get picked by robots whether they’re ordered in the store or remotely. It eliminates the distinction between online and in-store. When you automate the fulfillment at the store, the only difference is where the customer happens to be standing when they order those packaged goods. If they’re in their home, we would call that online. If they’re ordering from a screen in the store, we would call that in-store. But it’s not self-service. They’re selecting their items and the robots are picking the orders. This is automated service retail.

Do you have any plans to make your robots shop the same space as the customer?

No, we don’t. Customers will shop in a self-service fresh-market, and the robots will be isolated in the automated picking system. I don’t believe that people really value the opportunity to walk up and down aisles and select their own packaged goods. I think that once customers understand that all they have to do is order what they want via a screen, at home or in-store, and let the robots pick it, that there won’t be many people that say ‘I’d rather pick my own box of cereal’.

I think they want to pick their own produce and meat and seafood because those are different one from another. But the boxes of cereal are interchangeable. The fresh market is different as self-service actually adds value to many customers.

In 10 years’ time how many people do you think will need to touch a typical packaged item to fulfil an online order?

In the case of the packaged goods supply chain, I believe that it will likely be the case that in 10 years’ time there won’t be one single human hand that touches a product from the time that it comes off the manufacturing assembly line until the customer takes it out of the bag at their house. I think all of the handling of the product will be automated.

Ten years is a reasonably short timeframe to think about that happening on a very large scale. In five years’ time, it could be happening in small and more isolated supply chains.

How much has the capability or the potential of robotics progressed in the last few years?

The advances have been primarily in the cost of equipping the robot to do what it needs to do. For example, our robots now have six cameras on-board, so if we have a problem we can go to a robot and pull the video and see what happened. We can also pull video from robots that were nearby to get an external view.

Having six cameras on board today is quite affordable, whereas ten years ago it would have been very cost prohibitive. The computers that are controlling the robots are much more powerful and lots of sensors are now less expensive because of mass manufacturing.

As one example, the iPhone has a small gyroscope sensor which detects whether you’re holding it vertically or in landscape mode. We use the same type of sensor in our robot to help it know whether it’s level or when it’s climbing. That sensor would have been hundreds of dollars before the iPhone. Now it’s a small fraction of that.

The advance of technology everywhere feeds on itself and stimulates other advances. As the cost per unit of a machine gets lower and lower, it broadens the demand and broadens the applicability because now price points are economically feasible that weren’t feasible before.

Robotic picking is going to be critical. Until now the eye-hand coordination of humans has been more cost-effective in actually achieving the transfer of product from a product container to an order container. I think that’s about to change and that is an important capability within our system.

We can make our system much more compact. We can achieve a higher level of workstation density if it’s a robot picking it because we don’t need to provide as much space for access or safety like we do for human pickers.

What is your vision for how grocery retail will transform in the future?

Novastore is our vision of what will be achievable, and relatively soon. We hope that we can have the first automated store up and running within two years and that will mark the beginning of a transition. That store will be more economical to operate for the retailer, as well as providing a quantum improvement in customer experience.

Customers can order everything online, fresh and packaged, and have it delivered. They can order nothing online, walk in the store, place their packaged goods order on the screen, pick their own fresh and be done in 10 minutes. They can order everything online and pick up in the store. They can pick their fresh goods on the way somewhere, leave them at the store and then stop and pick them up on the way home or have them delivered to their house.

The customer experience will be dramatically better in terms of eliminating time and stress by creating flexibility about how you shop. At the same time, stores will operate far more efficiently and effectively. Being able to do both of those is what shifts the paradigm and we believe that this is going to be a much better form of automated retail and far more cost effective for the retailer than any other form of multi-channel.

Beyond that it’s easy for everyone to focus on the fulfillment. In order to pick products for an order the product has to be there and so you have to look at the entire supply chain – how does that product get replenished? What is the model for supplying the stores with the product to be picked? We believe that there’s a lot of opportunity in the automation of store replenishment by moving automation upstream to the distribution center.

If you think of the store as a machine that’s built to satisfy customers, it’s being run by a computer that’s interacting with the store associates and the customers and the robots in the store. It very accurately knows every item of every product that is available for picking and it can very easily determine when it needs to reorder so it sends a message up to the distribution center.

You would then have machines there that are designed to create the replenishment containers that go to that store. The whole supply chain becomes a network of machines that can operate far more efficiently because they’re all automated. It takes away a lot of labour and it improves response times and service levels by eliminating out of stocks. The whole system gets better and more efficient and lower cost.

In five years’ time, I think there will be retailers that are beginning to deploy these automated stores, first by building new ones and then by retrofitting existing stores. Customers have to come to understand the benefits of this model and choose to adopt it before you can get large scale retrofits going. That is going to be the gating factor as to how quickly retailers will start retrofitting their stores.

Images courtesy of Alert Innovation

Don’t miss our look at how else robots are coming to retail. Or book your future of retail presentation today and we’ll tell you everything you need to know to get ahead.