How is Adelaide helping brands understand the value of digital media?

Digital media is not all created equal. But the market seems to treat it as such leading to a lot of incorrect pricing.

This is where Adelaide comes in. It helps advertisers understand the true value of digital media to get them the kind of attention they want. In the process, Adelaide helps brands spot opportunities to snap up high quality, undervalued ad spots.

We sat down with CEO Marc Guldimann to understand how the company measures media quality, the value of attention and the process of revolutionising the advertising landscape.

Marc Guldimann, Founder and CEO, Adelaide

Can you describe Adelaide in a nutshell?

Adelaide helps advertisers understand the quality of the media they are buying through the lens of attention metrics.

Media used to be quite simple and homogeneous in the past being mostly TV spots or pages in a journal. In the last 25 years many new ways of reaching audiences have arisen, which created a problem.

As that fragmentation has happened, the quality and the value of all these different ways has increased exponentially in complexity, but the data used by advertisers to figure out how much they are willing to pay has not kept pace. They still judge the quality of the media through reach and frequency which creates both a risk and an opportunity.

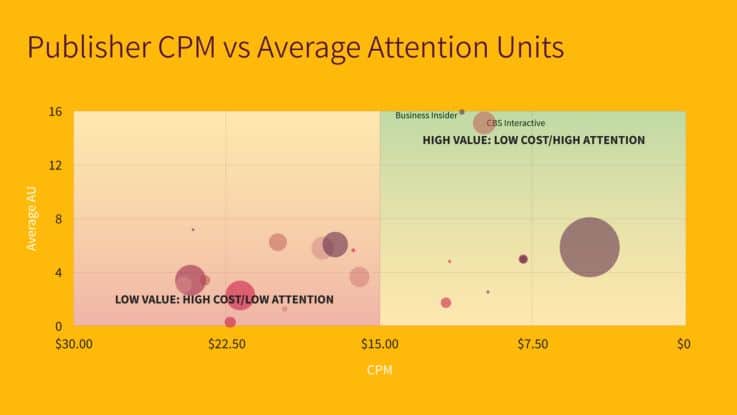

When you don’t know the quality of what you are buying, the risk is that you’ll be paying an incorrect price. On the other hand, if you are one of the few who understands it, there is an opportunity to encounter bargains and buy high quality undervalued goods.

How does Adelaide help advertisers find these opportunities?

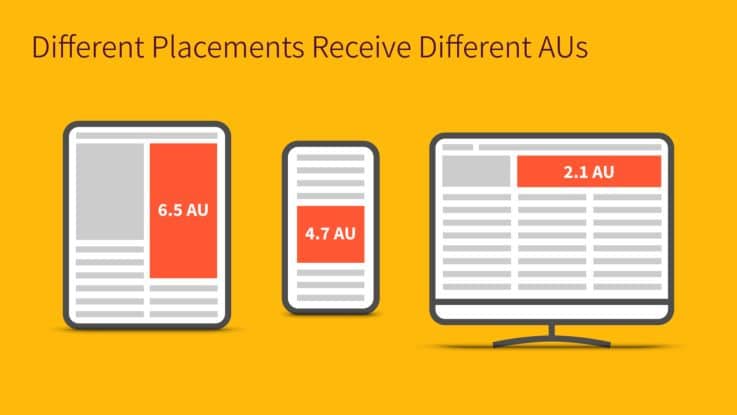

At Adelaide we use an ‘apples to apples’ metric to help advertisers quantify the quality of one ad placement versus the other and do a real comparison.

The metric is based on the theory that the goal of the media is to put the customer’s attention on a creative piece in a way that is not too intrusive nor easily interrupted. We have developed an algorithm to try to approximate this information by looking at a combination of different factors, such as the quality of the experience, people’s reactions, the context around it etc.

We gather this data through many ways: running JavaScript with the ad creative, sending a bot to the page, taking log files from ad servers, etc. Once all this information goes into the algorithm it generates a single number, which is a rating of a placement on that website – therefore allowing advertisers to understand the quality of that placement.

There is a concept in digital advertising called viewability, which basically looks at what percentage of the ad served actually showed up in the web browser. Until five or six years ago, advertisers were being charged regardless of whether the ad was actually in view or ended up at the bottom of a page.

When a report came out exposing the fact that only half of ads were ever really viewed, advertisers were upset and wanted to only pay for ads that are viewable. The problem is that ads are bought in bulk, i.e. thousands at a time, so a compromise had to be made.

What became a common standard across the industry was that ads needed to hit at least a 70% viewability target. This meant that placements that were about 65% or 60% viewable became very undervalued by the market, which created a ton of opportunities.

What was the inspiration behind starting the business?

We started around five years ago as an ad network called Parsec that would sell advertisers guaranteed attention. We were aware that advertising at that time was being sold using metrics which didn’t reflect the correct amount of value that was being transferred from a publisher to an advertiser.

Our solution was to buy attentive media on behalf of an advertiser and sell it back to them using a cost per second model instead of a cost per impression model. We were able to optimise the placements thanks to our economic model and deliver great results to our clients in terms of business outcomes.

The issue was that they didn’t want to buy all their media from an ad network, which is what Parsec was. They wanted to apply our technology across all of their media. This was the genesis for launching Adelaide – exposing the engine that we had built as a measurement solution for an advertiser.

Are you working on all channels at the moment?

We are currently only looking at the web, i.e. display, native and video advertising. We will hopefully soon start working on social networks as well. This is where ad formats are the most different, therefore there is a bigger need in these channels to understand their quality. From there the vision is to continue building and working on different types of media.

What is your top tip with regards to looking for undervalued ads?

Let me give you an example of a good buy and a bad buy in digital advertising.

The video format ads – that start playing all of a sudden on an online article – were specifically designed to game the metric of a completion. When they started to invest in digital, TV advertisers decided to use completions as the metric to judge the quality of these video ads; i.e. how many times has the video played all the way to the end. But they didn’t take into account other restrictions such as the audio being on for example; they went to the market looking to buy it as cheaply as possible.

A company called Teams figured out that they could put videos inside of text content and have them finish playing most of the time. So, these ads would meet the metric of video completion, but they didn’t have any value or impact on people, they were instead seen as obnoxious. These are an example of a bad buy that I would never purchase.

I would instead look for ads that are just below the threshold of viewability – maybe only on screen 65% of the time – but at the same time provide a lot of attention; for example, large ads in uncluttered pages. This is what I would consider a good buy.

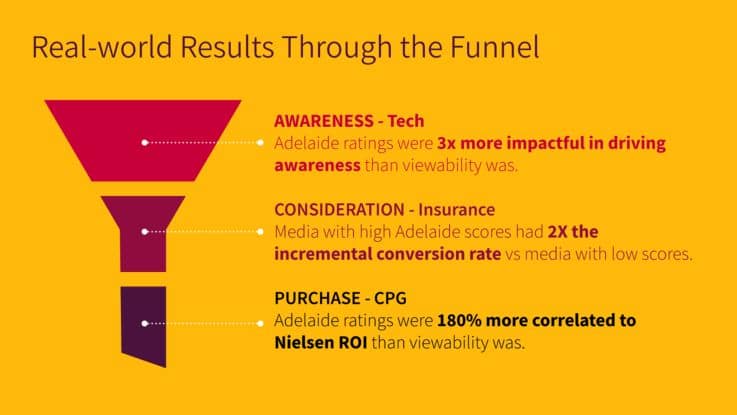

Can you give us an example of a case study that has achieved great results?

A good case study is a yogurt brand we worked with.

The company looks for incremental sales lift, i.e. the bottom of the funnel, so is focused on which ads will impact actual sales. This is difficult to quantify, the data is very sparse, and comparing amounts of yogurts sold versus amounts of ads shown are different magnitudes.

The traditional way the company did it was through ad viewability. The problem was that over time, publishers started making mostly viewable ads that weren’t high quality, for example all placed at the top of a very cluttered page.

This is where we came in and suggested to the company to instead start buying more high-quality ads that actually capture attention. They decided to split their campaign in half, one half going to optimising the old way towards viewability, and the other one going the new way towards attention. I.e. one KPI was the cheapest impression possible and the other KPI was the cheapest attention possible.

At the end of the campaign they compared the correlation with the outcome for both. What transpired was that we were three times more correlated and 1.8 times more efficient, therefore optimising to attention was indeed driving up more sales.

We had initially built Adelaide to help top funnel advertisers understand quality, but it turned out to be just as effective at the top of the funnel as it is at the bottom.

What are your thoughts on the value of attention and how it is changing?

At Adelaide we don’t deal with raw attention, we deal with the opportunity for attention.

The value of attention is increasing greatly because of the growing quantity of information and screens that people have. Now more than ever, when people choose to pay attention to something they are much more likely to switch their attention quickly, so it is critical to show them things that are interesting to them. Companies need to really invest in the creative side of high-quality media, which wasn’t particularly the case 25 years ago.

Once you can measure the quality of creative over the long run, you can actually optimise towards better advertising that will have a profound impact on brands. It will move away from the gaming metrics of gaining views, impressions and completions towards real, authentic consumer attention.

Some brands like Nike and Red Bull are already doing that; they make content that people choose to watch. No brand wants to be annoying or obnoxious, they want to be relevant and sell their products to their targeted customers. The problem at the moment is that they don’t have any feedback loop, which is hopefully what attention metrics will become.

How do you see online advertising changing in the future?

I believe the biggest shift in digital advertising is going to be around the unintended consequences coming from privacy regulations. Online advertising is going to become much less targeted which will have some negative repercussions, mainly in the way of frequency capping.

There is a natural law of frequency happening in broadcast mediums which doesn’t exist in digital. For example, when you buy 3 million ad impressions in TV advertising and run three TV spots that reach a million people each, you then know that the highest frequency is three. In digital, we rely on identity in order to frequency cap, i.e. how many times do you show somebody an ad before you can stop.

Privacy regulations are going to make brand advertising more difficult in digital environments that don’t allow for natural frequency capping. This will push people to advertise more in walled gardens like Facebook, YouTube, Instagram etc where they do have identity built in and can use a frequency cap.

What’s coming next for Adelaide?

We have created something called the Attention Council. It’s a group of small companies building technology around attention, along with brands that are interested in finding more efficient ways to capture consumer attention. Some brands that are part of it are Microsoft, Mars, Diageo, etc.

We partnered with one of the companies – called TVision – to release a leaderboard which will show at a very basic level who the top 20 publishers on the web and the top 10 TV shows on linear TV are in terms of the quality of attention.

TVision works to find TV shows that have the highest quality advertising placement. They install an eye tracker in the living room of a few thousand people they have on a panel. This tells them what programme is playing, if people are in the room, if they are actually looking at the TV and paying attention to the ad etc.

It is similar to what we offer, but it might be a bit easier to understand for advertisers. There is also an arbitrage opportunity to buy ads in TV shows, as they are undervalued by Nielsen’s ratings.

Is there anything else you’re working on?

When we were running Parsec (the ad network), I had in mind that there were two ways to solve this market.

One was to help publishers create contracts that actually represent value and give advertisers the tools to buy undervalued quality items – which is what Adelaide does.

The other was to create an advertising futures and options exchange, similar to a commodities one. This is a separate business that we’ve spun out called AFOX.

It basically allows people to buy and sell contracts which represent the right to advertise at some point in the future. This doesn’t usually happen in advertising today outside of TV, and even then, it is not very liquid.

My theory is that because people don’t understand the quality of media, because they have no confidence in its future value, they won’t engage in long-term contracts. But once that contract is denominated in some guaranteed amount of attention, they will start having the confidence in engaging in the futures marketplace. This will help publishers, for example, to sell inventory before it has been produced, allowing them to actually finance their business ahead of time.

Images courtesy of Adelaide.

Want to add some wonder to your retail business? Our consultants can help you define a customer-grabbing strategy for your stores.

Related Articles

Below are other articles from our blog that cover similar topics: