Locating opportunities: Huq Industries on the contextual power of real-world Wi-Fi captured location data

Ad-free app monetisation is how Huq Industries describes its platform. Real-world location data capture is a good way to describe the core functionality, but the model is somewhat different to the usual GPS analytics. Every time a mobile app containing Huq’s code logs into a Wi-Fi network the company tracks it to create high-level anonymised audience intelligence reports.

Through these reports retailers and other businesses can see where people go, where they spend their time, what devices they connect to what, and as Conrad Poulson, CEO of Huq Industries explains, context is everything when it comes to understanding customers.

Can you want describe Huq Industries in a nutshell?

Huq was formed from the importance of context, where I am when I’m looking at a piece of content, or searching for a product is a really important data point in terms of giving me the best experience and reacting to my needs.

I think we’re still really in the foothills of people getting their heads around that. The speed at which we’re moving from online to mobile and the implications of that is already quite a lot to get your head around. Then what does it mean to have this other dimension of physical context if I’m on the bus versus if I’m at work, versus if I’m sitting on the sofa at home.

We’re trying to help understand how consumers behave in the real world and that leads to lots of other interesting applications of the data. At the heart of it that’s what we’re about, trying to bring the same kind of level of insight to offline behaviour as you can get from online behaviour. We think by revealing that, we help businesses understand how the world works and how their customers work.

The failings of GPS

What data does it capture and what can you learn about users?

The first thing is we’re not interested in individual users per se. Of course our data is made up of individual users, but our interest is not only understanding that this user has been to these places in order that we can target that person with content or advertising. That’s not the point. The point is about understanding the behaviour of large groups of people.

We believe there’s an alternative value exchange we have from the one that you currently get as a user. We know that the typical value exchange at the moment is I give away loads of my data, advertisers use it to try and sell me stuff in order that the app that I use can fund itself. We see a different type of exchange where your data can be used to contribute towards this pool of behavioural insight. There’s huge value in that, but the way the value is realised is seamless to the user. Not that they don’t know about it, but it’s seamless to their experience.

So the data that we’re interested in is the places and objects that a device connects with. I think what’s happened so far in location is there’s been one source of data which companies have been able to leverage and that’s GPS. That’s fraught with issues. GPS tells you where but it does not necessarily help you get to the what, and that’s really what we’re interested in.

The fact that I’m close to a Pret A Manger does not tell you that I’m a Pret A Manger customer. That’s the difference that we’re trying to get to, which is to understand that if you’re a Pret A Manger customer, it is about the nature of that particular individual.

How can your information know this and GPS doesn’t?

We look at when a device connects to a Wi-Fi network or beacon, so we use that active connection as a proxy for a visit to that place. The trade-off we make is of course not everybody who visits Pret connects to the Pret Wi-Fi, but a statistically meaningful number do, so that’s what we’re looking for because those are explicit connections. They’re not I just happened to be near. In order for that connection to happen, you’ve got to have dwelled in that place, you’ve got to be very close to that place, you need to be inside it, so that’s what we’re looking for.

So we look for a connection, we see the network it’s connected to and then we make the association as to what that network belongs to. So does that network belong to a retailer, or a corporate, or a train. Then if we know that business is Pret we are also able to determine that Pret is a cafe sandwich chain versus an independent coffee shop versus a fine-dining restaurant. That knowledge helps us profile that audience.

Do you use GPS data as well? If the GPS was in a Pret for half an hour, could you quite confidently say they were a customer?

We do use GPS, we need rough locations.

Your average GPS signal probably gives you a radius of about 65 metres. So the only thing you can say with confidence is that that user is within that 65-metre radius. You don’t know quite where they are. You assume that it’s the centre of that, but that’s not necessarily the case.

If you’re Pret on Oxford Street a 65-metre radius is quite large. It covers several places, so maybe I’m dwelling there, maybe I’m not. The second point is that if you’re in a store which is has is more than three floors deep, GPS gives no idea about whether you’re on the lower floor, the middle floor, or the upper floor. You have no context of that either. There are a lot of things that it can’t do basically.

That’s even if you own the GPS signal. I mean most businesses that are working in the geo and proximity space don’t collect that data themselves. They rely on the publisher of the app or the website to provide geo data alongside their ad request, and the ad exchange will list geo data and that’s the point that they are picking it up. Aside from the big challenge that they have, which is in that environment you can’t say I want GPS data with this accuracy, they just have to take what is given. Sometimes it’s 100 metres, 200 metres, so you then end up with very variable quality of data.

It’s good enough to say, “I want to target an advert to anybody who’s within 100 metres of Pret. It’s fine because whether it’s 100 metres or 150 metres, or 200 metres even, this probably doesn’t make a huge amount of difference, it’s good enough. It’s not good enough to get to a behavioural level.

You can get very high-accuracy GPS, if you use Apple Maps and Google Maps, you can see that it’s pretty good at positioning you, whether you’re on the pavement or in the middle of the street. But the only way they’re able to do that is this hugely power hungry map application. Most apps would never ask for GPS with that kind of accuracy, because the trade-off is huge.

We’ve got patents around the way that we collect that data that’s incredibly powerful, because no developer will put a piece of code into their app, which the users thought were killing the battery.

The challenge is finding original data that you have some degree of control over the quality and the nature of. Finding a way to get our code distributed into millions of apps you know is a fairly pivotal moment for us. That’s a challenge that lots of people are grappling with how to capture that as first pass data.

Marrying data

How many apps do you have connected to your programme?

We’ve got about 1,200 apps.

What are the biggest apps? Are there any household names on your roster?

We’re talking to a couple of household names right now, but where we’ve had most traction so far are the sub-one million user-type apps. We are talking to some of the bigger apps, but it’s a much longer cycle to get into those guys just because they’re much more cautious about the impact on their adoption and upgrade of the apps. If you’re asking for extra permission, then that might lead to some falloff and they’re very wary of that trade-off. We’re in discussions with a couple of newspapers, but we’re in a lot of travel and transport apps, utility apps, training apps, games.

Are you allowed to talk about what brands or users on the other side that you’re working with?

The biggest category for us is financial services, so we have partnered with a U.S. company who is selling out data into hedge funds. We have commercial trials with a couple of the leading consumer data businesses and a couple of market research industry leaders.

Do you have any individual retail brands working with you?

We mainly sell through channel partners, so we’re working with for instance a couple of ad agencies, and media agencies that do have retailers as their clients, so we are indirectly working for them where they take our data to do a piece of assessment for one of their retail clients.

We’re going to launch a product with one of the leading creative agencies in London for shopper marketing and path-to-purchase insight, so they’re going to use our data in that.

Are there any other things that the app brings into the data mix?

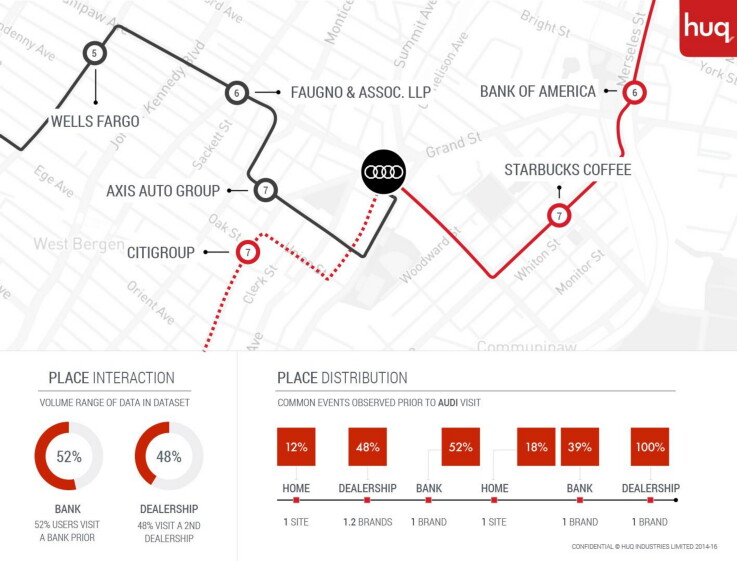

Right now, we don’t get transaction data. We just finished a study for a car brand on path-to-purchase and the visits to car dealerships, and so of course, we don’t know whether that actually ended in a transaction.

But we look for other behaviours, which suggest that it did. So for instance in that piece of analysis we found consistent visits to the car dealerships and then we found ones where was a visit to the bank after the dealership, and then from the bank to the dealership, so looking for signals and identifying patterns of behaviour, that they’re sourcing the financing before they buy the vehicle.

So we don’t currently integrate any other data, but it’s something that we’re looking to do. We have for instance a couple of loyalty apps that have included our SDK in their apps and obviously they do get transaction data. At some point, we’ll be able to marry those up, so there are a number of apps we work with who throw off data, which they don’t currently monetise, which we will help them to monetise and we will join up. Lots of our customers for our data are hungry for any other layers of data that we can add on to that.

Is there a way of capturing an email address? Could you anonymise that and say yes, Individual A did this and then bought something?

The challenge there is if you’re starting to hook up email addresses you’re very much crossing the chasm into personably identifiable information It’s one of our central tenets really that we don’t marry this data up to an individual because of the way we want to use it is not to profile individuals. So not right now, no but we could do other things.

We do see an increasing amount of phones being connected to a car. The cars that are rolling out have Wi-Fi or use low-fidelity flow energy in order to help you connect the phone to the systems in the car. We can a lot of the time identify the manufacturer of the car, so we could see a switch that this person used to be connecting their phone to a BMW, and now they’re connecting their phones to an Audi.

We see device ownership and I’m not just talking about the mobile device, but all the peripherals that mobile connects to and the changing behaviours as being something that we’re going to see more of and be able to create more value from at the time. If you think about a smart home or connected objects, we see the phone as being pretty central to that world, certainly around personal Internet of Things.

Also increasingly your device is interacting either actively or passively with the environment around it through connected objects. And so understanding those patterns and knowing what those objects are, yeah it’s pretty central to us.

I think it’s a massive opportunity for us. We’re not really interested in the traffic going over that, knowing what car or connected watch, gives a pretty good insight into the world that that device occupies.

Enabling true omnichannel retail

Can you tell me more about the most interesting decisions you’ve seen that Huq’s data is feeding into?

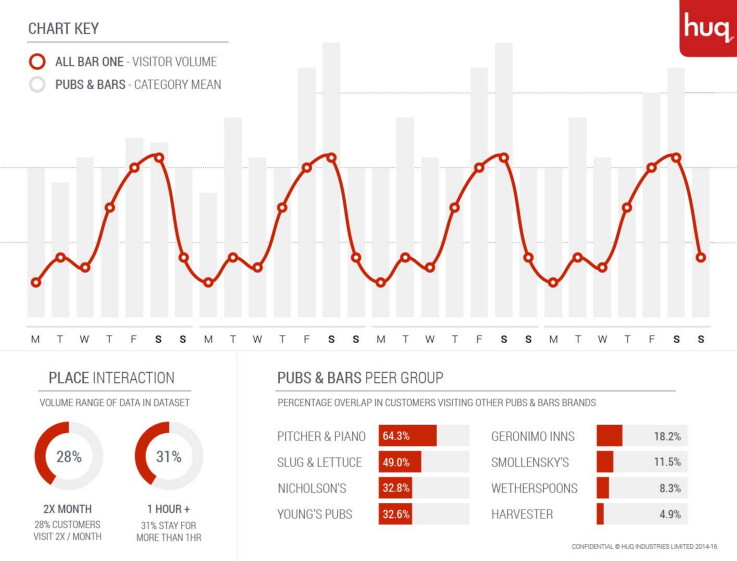

The most immediate one is clearly the finance one, which is how well retailers are performing relative to each other. That is a fairly simple one in terms of our data as a proxy for footfall, so is Wal-Mart having a good week or not. I think there is some very interesting stuff that we’ve just been working on around offline attribution.

The example that we’ve been working is with an outdoor media business on attributing the performance of outdoor digital media. For instance, we get a very good view of underground stations, most underground stations have Wi-Fi, we see the devices that are connecting to that station.

We have working with this agency on looking at the campaigns that they were running, specifically around local campaigns that they were running within those environments. Say, for instance McDonald’s is running a campaign within Oxford Circus station directing you to the nearest McDonald’s outside the station for some kind of deal, we are able to attribute the performance of that.

We know that these people went through Oxford Circus station and we know that they went to a McDonald’s afterwards. Did more people do that in the days when the adverts were running in the station versus the other days? That’s been a really big challenge for those guys historically to prove the value of that kind of media. Measuring the performance of it is pretty tricky. Did more people go to McDonald’s this week because of that or were other factors at play – that’s something they’re always trying to justify.

Do you have a killer use of the platform in mind in terms of retailers?

I think we’ve seen two ways of retailers using our data. One is in the scenario where it’s not about their own customers necessarily. For instance, irrespective of whether we’re in a retailer’s app or not, we’ve got a view of what their customers are doing, where else they’re going.

So if we see people connecting to Wal-Mart’s Wi-Fi, even without any relationship with Wal-Mart, we can we give them some pretty powerful insights into what else their users are doing. Eg, where they’re travelling from, where home is, where work is, those kinds of patterns of behaviour, where else they’re spending their time when they’re not at Wal-Mart, if they substituted a visit to Wal-Mart this week which other retailers did they go to.

With our software in their app, they can start to really, really get to both understand their audience at this kind of level of detail, but also ultimately be able to react to the needs of that audience. For instance, if I’m in John Lewis’ app, and I’m standing in House of Fraser doing a comparison, our tech would enable John Lewis to understand that this user right now is standing in House of Fraser searching for this product in my app.

I think we’re probably a little way away from that, but we could enable them to dynamically price that, if I know that this user is in my app, looking at lighting while standing in House of Fraser, what do I do with that information? Ultimately you would want to be able to react to that, right? You would want to be able to kind of compete for that business with that knowledge.

We’d love to get to that point. I think the first stage for us is getting across the data and using it from a more planning, strategic point of view, but ultimately I think once their omnichannel strategies are fully up to speed, we could use this in a more programmatic sense.

Does Huq have a back-end platform where people can get insights?

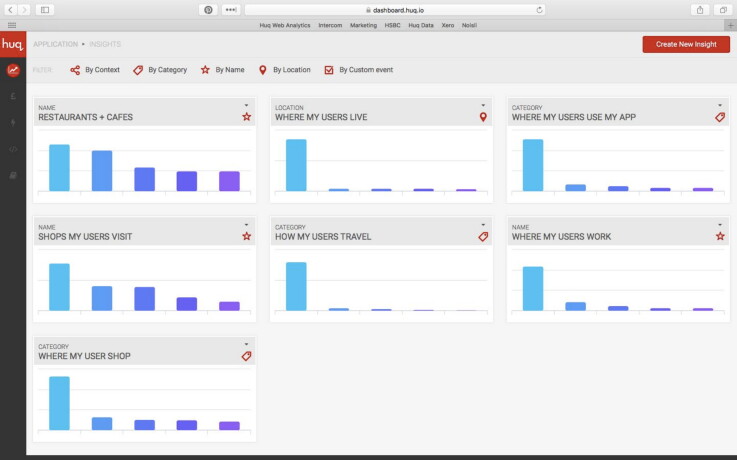

Yeah, we do. At the moment, we have a free product that we give to any of the app owners that install our code, and it gives them high-level analysis on the behaviour of their audience. Most app owners who put our code in are really only interested in earning revenue. Then there’s a small percentage of them that would want to use the data for adapting the user experience of the content. We anticipate that that will grow over time.

At the moment we give them a free product, which can show where most of your users live or where they shop, or how they travel, or where they work. We have a digital dashboard, so they can see, “Okay, is there stuff in here which I can use?” If there is, then they can have a more technical relationship with the data that they can extract and use it through their push-messaging platform they have or their CMS, or their CRM.

Next phase of functionality

Is that for the clients who buy the data as well?

We started to build our own, and then we stopped because there are so many good visualisation tools out there. We have an API feed but if you’ve already got Tableau or whatever, you can injest the data into that and visualise to your own preferences.

We’re just selecting a provider right now to do our default dashboard, which will be an established tool. What we learned was that everybody’s got dashboards coming out of their ears, so the last thing they wanted was another dashboard, they want to be able to generally integrate with whatever they’re already using.

What’s next for Huq? How are you planning on evolving the platform functionality?

The next thing is twofold: one is continuing to grow the number of apps that we work with so we are targeting 300 million events right now a month. We would like to be doing one billion events a month, which we plan to hit in 2017.

Also, broadening the number of verticals that we sell the data into, and that’s through finding specialist partners in those individual verticals, so property, or city planning, or retail. Our strategy is very much a partnership. We want people to understand how to use this data in different domains.

Where are those one billion events going to take place? Which regions do you think are you going to tap?

We break the world down into three big regions. We have region 1. Region 1 is our high-priority status, which is basically where we already have customers for the data, so that’s US, Western Europe, Japan and Korea. Those are the areas where we have proven demand, and we continue to target apps that have new spaces in those geographies.

I think we’re collecting data from about 83% of 250 registered territories worldwide, but not all of them in high-density. Generally we wait for customers to come to us and say we’re doing something specific in the Turkish market, so we’d like data from Turkey. We will have some data on Turkey, but not high-density and if there’s the commercial demand for it we will acquire apps with users in Turkey.

By 2017, what proportion of these one billion events do you think region 1 will be generating versus the others?

Region 1 probably about 60%. China is clearly going to be a big one for us. We don’t have a lot there right now but it will be a big region for us. Also, we’re talking to a partner in India, and it’s interesting in developing markets like that, actually it’s quite easy to acquire data in those countries. A lot of app usage, a lot of Wi-Fi usage, which is good for us.

We’re doing a project right now for a luxury brand in China, trying to understand how do you identify and find the behaviour of customers for luxury products.

Images courtesy of Huq Industries